straight life policy develops cash value

Face value of policy is paid at age 100 B. The face value of the policy is paid to the.

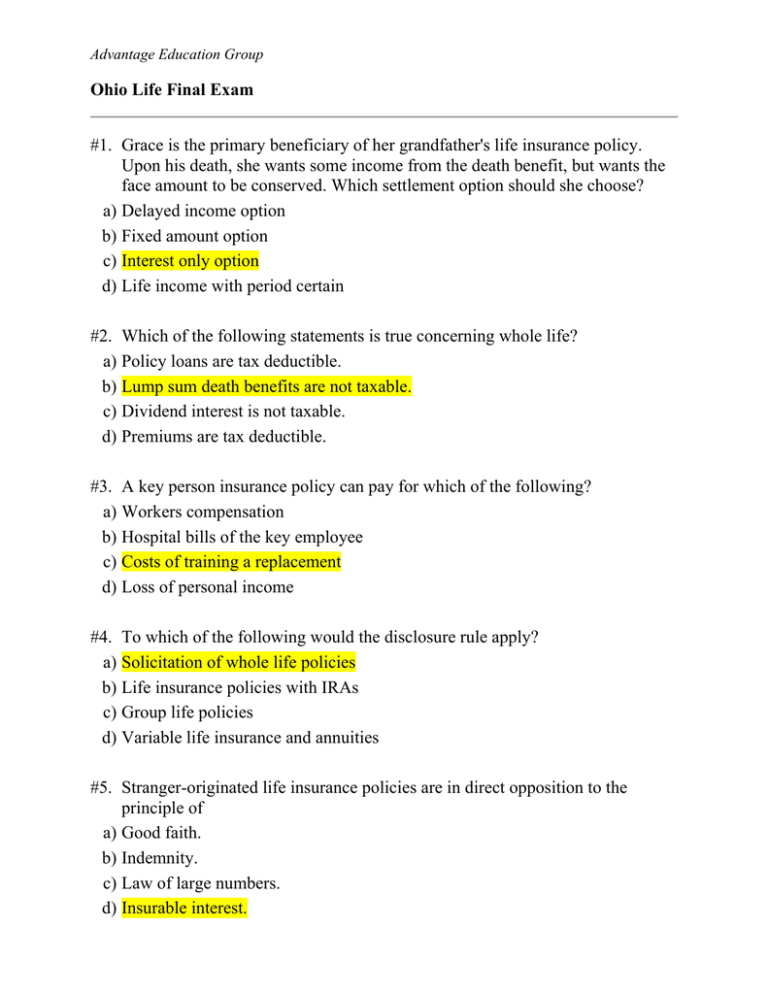

Life Insurance Flashcards Quizlet

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

. A method used in actuarial analysis which is often used in the insurance industry. The face value of the policy is paid to the. A cash value life insurance policy requires a long term commitment as you will need to pay these premiums.

As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan. In addition to a death benefit for your beneficiary and cash value for you straight life insurance offers a variety of benefits not found in other policies. The gross amount of collections expected to be obtained through the liquidation of assets in an asset pool.

Get a quote from a licensed life settlement broker today. The best way to use the cash value in your whole life insurance policy is through a policy loan. For example suppose you take out a whole life insurance policy for 100000.

The term straight life single-premium immediate annuity refers to the same thing. When to buy a cash value life policy. Usually develops cash value by end of third policy year C.

You make 10 years of payments and build up a cash value of 10000. Ad Have over 100K in life insurance. Toward policy fees and changes.

The total payout amounts depend on several factors including your life. It has the lowest annual premium of the three types of. Try Our Life Insurance Settlement Calculator To See Your Quote Instantly.

The rate of return will typically be large enough that. Premiums for cash value insurance policies can be significantly higher than for term life policies. C It usually develops cash value by the end of the third policy year.

The face value of the policy is paid to the insured at age. It usually develops cash value by the end of the third policy year It has the lowest annual premium of the three types of Whole. This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the.

The face value of the policy is paid to the insured at age 100. The initial targeted cash value or. Which statement is NOT true regarding a Straight Life policy.

Which statement is NOT true regarding a Straight Life Policy. Ad No Intermediaries Or Fees. The Yearly Price Of Protection Method is used to find out.

Yearly Price Of Protection Method. Has the lowest annual. The face value of the policy is paid to the insured at age 100.

A straight life insurance policy can also build cash value over time. Which statement is NOT true regarding a Straight Life policy. Heres a look at the three options and why a policy loan is often the best solution.

Premium steadily decreases over time in response to its growing cash value. It usually develops cash value by the end of the third policy year. Straight Life policies charge a level annual premium throughout the insureds lifetime and provide a level guaranteed death.

The term straight refers to the whole life insurance policys premium structure. Which statement is NOT true regarding a Straight Life policyA. Cash value life insurance premiums are high compared to term life insurance.

Trust Abacus Life With Getting Your The Largest Payout Possible. Time in response to its growing cash value. Its premium steadily decreases over time in response to its growing cash value 2.

Dividends and Interest. It usually develops cash value by the end of the third policy year. This is a straight life annuity that starts paying you back as soon as you acquire it.

Toward the cost of actually insuring you. With cash value life insurance your premium payments go three places. Into the cash value.

However cash value policies can accrue. Which statement is NOT true regarding a straight life policy. Initial Targeted Cash Value.

You can even cash in the surrender value of a life insurance policy. How Much Does a Straight Life Annuity Pay Out. Which statement is NOT true regarding a Straight Life policy.

B Fees required by the company to provide the coverage and c Cash value which is an investment account associated with the life insurance policy. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest.

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

Life Insurance Life Insurance Life Insurance Exam Prep Life Insurance Life Insurance Life Insurance Life Insurance Life Insurance Key Concepts Life Insurance Life Insurance Chapter 1 Health And Life Insurance Flashcards Quizlet

What Is Straight Life Insurance Valuepenguin

Life Insurance Life Insurance Life Insurance Exam Prep Life Insurance Life Insurance Life Insurance Life Insurance Life Insurance Key Concepts Life Insurance Life Insurance Chapter 1 Health And Life Insurance Flashcards Quizlet

Life Insurance Cover Quotes Uk Budget Insurance

Life Insurance Flashcards Quizlet

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

Business Continuity Planning For Government Cash And Debt Management In Technical Notes And Manuals Volume 2021 Issue 010 2021

Life Insurance Flashcards Quizlet

Life Insurance Flashcards Quizlet

:max_bytes(150000):strip_icc()/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Business Continuity Planning For Government Cash And Debt Management In Technical Notes And Manuals Volume 2021 Issue 010 2021

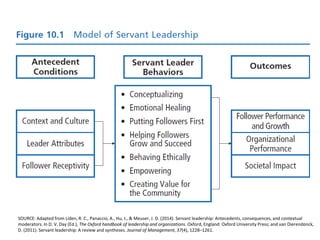

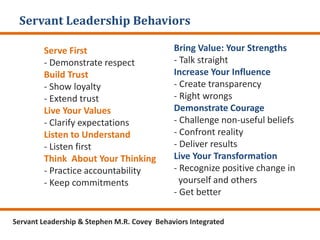

Servant Leadership Develops The Building Blocks For Successful Busin

Is Whole Life Insurance A Scam Why I Fell For It White Coat Investor

Servant Leadership Develops The Building Blocks For Successful Busin